Ford Motor Company and Redwood Materials are collaborating to build out battery recycling and a domestic battery supply chain for electric vehicles.

Ford and Redwood’s goal is to make electric vehicles more sustainable, drive down the cost for batteries, and ultimately help make electric vehicles accessible and affordable for more Americans.

Ford and Redwood are collaborating to integrate battery recycling into Ford’s domestic battery strategy. Redwood’s recycling technology can recover, on average, more than 95% of the elements like nickel, cobalt, lithium and copper. These materials can be reused in a closed-loop with Redwood moving to produce anode copper foil and cathode active materials for future battery production.

By using locally produced, recycled battery materials, Ford can drive down costs, increase battery materials supply and reduce its reliance on imports and mining of raw materials.

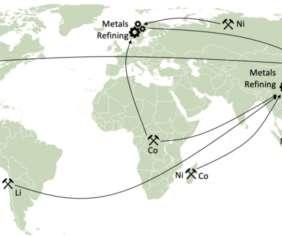

The existing battery supply chain is a convoluted system that requires materials to travel tens of thousands of miles before they make their way into a final product. In looking at the supply chain for a single component such as cathode, the logistics required alone contribute enormously to the overall cost and carbon footprint. Source: Redwood Materials

Ford is investing more than $30 billion in electrification through 2025, including the collaboration between Ford and Redwood, which will help deliver on Ford’s plans to localize the battery supply chain.

This builds on Ford’s previously announced plans to scale battery production through multiple BlueOvalSK battery plants in North America starting mid-decade. (Earlier post.) By building out a domestic, sustainable supply chain with recycled materials, Ford can drive down battery costs and help protect the environment. BlueOvalSK is the US joint venture that Ford and SK Innovation intend to form, subject to definitive agreements, regulatory approvals, and other conditions.

Last week, Redwood announced plans to produce anode foils and cathode materials domestically and its intentions to ramp to 100 GWh of cathode material, enough for one million electric vehicles by 2025. By 2030, Redwood expects production output to scale to 500 GWh/year of materials which would enable enough batteries to power five million electric vehicles—nearly half of the US’ annual vehicle production.

Redwood plans to transform the lithium-ion battery supply chain by offering large-scale sources of these domestic materials to reduce the cost and environmental footprint of electric vehicle production.

The local supply of these two materials is a key part of Ford’s commitment to reduce the environmental impact of battery manufacturing and continue to ramp up electric vehicle production in the US.

Redwood Materials, founded by JB Straubel and based in northern Nevada, is creating a circular supply chain for batteries and helping partners across the electric vehicle and clean energy industries by providing pathways, processes, and technologies to recycle and remanufacture lithium-ion batteries.

Longer-term, Ford and Redwood plan to work together on the best approach to collect and disassemble end-of-life batteries from Ford’s electric vehicles for recycling and remanufacturing to help reduce the cost associated with battery repairs and raw materials to manufacture all-new batteries.

To further these business opportunities between the companies, Ford invested $50 million into Redwood Materials to help the company expand its footprint in the US.

In July, Redwood announced a more than $700-million external investment from a carefully selected group of strategic investors. The round was led by funds and accounts advised by T. Rowe Price Associates, Inc. and includes Goldman Sachs Asset Management, Baillie Gifford, Canada Pension Plan Investment Board, and Fidelity. In addition, all Series B investors, Capricorn’s Technology Impact Fund, Breakthrough Energy Ventures and Amazon’s Climate Pledge Fund, returned for this round and Valor Equity Partners, Emerson Collective, and Franklin Templeton also participated.