From hitting the 1,000-mark on July 25, 1990 to reaching the 60,000-mark for the first time on Friday, it has been a historic and memorable journey for the benchmark index Sensex.

It has taken a little over 31 years for the Sensex to traverse from 1,000 to the famed 60,000 level now.

Over the years, the front-line index has climbed several record levels.

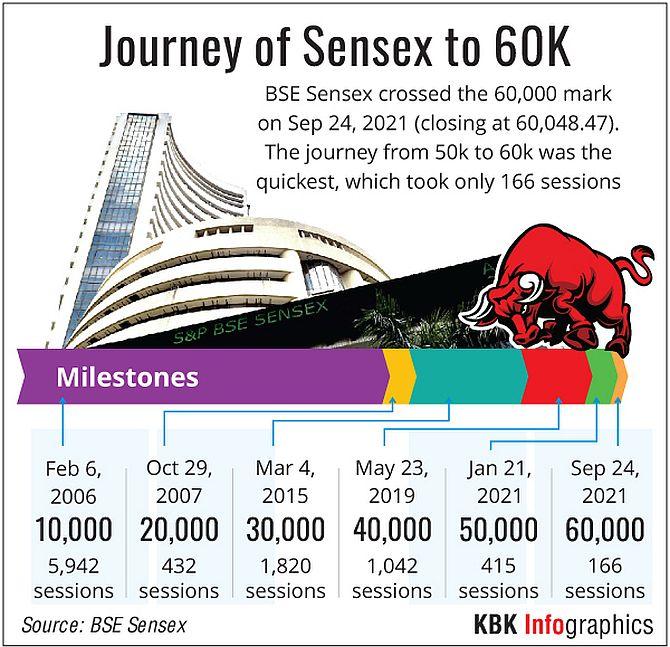

The index had reached the 10,000-mark for the first time on February 6, 2006. On October 29, 2007 it scaled the 20,000 level; then on March 4, 2015, the benchmark hit the 30,000-mark. The BSE benchmark scaled 40,000 on May 23, 2019. The 50,000-mark was reached on January 21, 2021.

Interestingly, both the 50,000 level and 60,000 mark have been breached in 2021, showing the resilience of the market amid Covid-19 devastation.

Eventful history

From witnessing the Harshad Mehta scam in 1992, to blasts in Mumbai and the BSE building in 1993, Kargil war (1999), terror attacks in the USA and Indian Parliament (2002), Satyam scam, global financial crisis, demonetisation, PNB scam and Covid-19, markets have faced many uncertainties over the years, suggests a slide on “Journey of Sensex” tweeted by BSE CEO Ashish Kumar Chauhan on Friday.

Several healthy triggers have also played a major role in market uptrend, with the likes of commodity boom in global markets, global liquidity, Covid-19 vaccine approval and rollout of vaccination programme.

The BSE benchmark index has gained over 25 per cent so far this year.

In August this year, the stock market reached many new highs. The BSE benchmark soared over 9 per cent last month.

Covid tailspin

The remarkable rally in the markets holds significance as equities had gone into a tailspin in March 2020, with the BSE benchmark sinking a massive 8,828.8 points or 23 per cent during that month as concerns over the pandemic’s impact on the economy ravaged investor sentiments.

Also see:Sensex wobbles after crossing 60K, Nifty holds below 17,900

The BSE benchmark had gained 15.7 per cent in 2020, after facing a roller-coaster ride during the year hit by the pandemic.

“The sentiment on D-street is bullish. A dip of a couple of per cent would be a good opportunity for traders and investors to enter.

“We are witnessing broad-based buying from large-caps to mid-caps, and small-caps. The euphoria in the market is likely to continue. It may extend till January-February 2022. Though volatility is likely to witness an up-tick,” said Brijesh Bhatia, Senior Research Analyst at Equitymaster.

Following are some major market trends in 2021:

* January 21: The BSE benchmark Sensex touches the momentous 50,000-mark in intra-day trade on January 21, 2021

* February 3: Closes above 50,000 for the first time

* February 5: Crosses 51,000-mark in intra-day trade

* February 8: Ends above 51,000-level

* February 15: Rallies above 52,000

* June 22: Reaches 53,000-mark in intra-day trade

* July 7: Closes above the 53,000-mark for the first time

* August 4: Benchmark goes past 54,000 for the first time in intra-day trade and also closes above this mark

* August 13: Rallies above 55,000 for the first time and also closes above this level

* August 18: Goes past 56,000-mark for the first time in intra-day trade

* August 27: Closes above 56,000

* August 31: Goes past 57,000 in intra-day trade and also closes above this level; market capitalisation of BSE-listed companies reaches Rs 250 lakh crore

* September 3: Scales 58,000-mark in intra-day trade and also closes above this feat

* September 16: Reaches 59,000-mark for the first time both in intra-day and at the close of trade; market capitalisation of BSE-listed companies breaches Rs 260 lakh crore

* September 24: Reaches the 60,000-mark both in intra-day and at the close of trade

The benchmark index has gained 12,297.14 points or 25.75 per cent so far this year.