The world is a cold place, and my heart breaks for the citizens of Ukraine. This horrific situation should remind us that the world is an imperfect place, and we don't live in a Utopia. The geopolitical environment can change at the drop of a dime, and this shouldn't be a surprise as wars have been waged for thousands of years. Geopolitical tensions continue to escalate, and speculation as to whether China will invade Taiwan increases. Nobody can accurately predict if China will invade Taiwan, but we can certainly speculate about the global impacts. Apple (NASDAQ:AAPL) is one of my favorite companies, and it's been the bedrock of the market throughout the recent volatility. The Nasdaq has declined by -14.90% in 2022 and by roughly -17.89% since the middle of November 2021. Over the past year, Apple has appreciated by 35.83%, while the Invesco QQQ ETF (NASDAQ:QQQ) has appreciated by 10.92% and, compared to the QQQ, has only declined by -8.11% in 2022 compared to -15.22%. In January, it was reported that roughly 40% of the stocks within the Nasdaq had lost half their value since November. AAPL has been a safe haven for many investors, and the real question is which direction will AAPL gravitate toward in the future.

I believe an argument can be made for AAPL appreciating to $250 prior to 2024 or plummeting below the $100 level if China invades Taiwan. While I don't believe anyone wants to see another war break out, both scenarios are plausible, and investors should evaluate both scenarios. AAPL has many catalysts, and something that isn't discussed enough is that AAPL can manufacture larger EPS. The market has turned its back on growth and is more concerned with a company's ability to generate free cash flow (FCF) and EPS rather than revenue growth rates. AAPL has FCF generation and EPS in spades. If China invaded Taiwan, a $100 share price for AAPL could be conservative, and shares could go lower. There are too many factors to quantify what would occur. We still have inflation which has surpassed 7% and are going to enter a rising rate environment. I believe investing in companies with strong financials is the best investment today, and AAPL is at the top of the list.

What if China invades Taiwan, how would Apple be impacted?

I pray that China doesn't invade Taiwan. Put investing aside for a moment; if China invades Taiwan, our stock portfolios will be the least of our concerns. So, what is the difference between Ukraine and Taiwan? The Taiwan Relations Act (H.R2479) established in 1979 obligates the United States to assist Taiwan in maintaining its defensive capabilities. President Biden has been very clear that we will defend every inch of NATO territory in the Russia / Ukraine scenario while vowing to protect Taiwan if China enacts an invasion. Some are convinced that China will invade, and others are skeptical, but what is concrete is that if China does invade, the United States will be involved militarily.

The global chip shortage has impacted various sectors, from the auto industry to technology companies. Everything from automobiles to networking equipment and personal computers has been impacted. In 2020, Taiwan dominated the foundry market, accounting for more than 60% of total global foundry revenue. At the end of 2021, a report indicated that 63% of the global supply of semiconductors originated from Taiwan. China accounted for an additional 7%, so they would control approximately 70% of the global semiconductor supply if China were to invade Taiwan.

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has a $547.43 billion market cap and is the largest global foundry, controlling 54% of the market. TSM makes chips for AAPL and other critical companies such as Advanced Micro Devices (NASDAQ:AMD), Intel Corp (NASDAQ:INTC), Nvidia (NASDAQ:NVDA), and Qualcomm (NASDAQ:QCOM). When you look through TSM's 2021 report, 44% of their annual revenue was derived from smartphones and 37% from the home PC market.

Uncertainty is upon us, and if the worst occurs, the global chip shortage we recently experienced could resurface and be amplified several times over. I am not saying this will occur, but it is a possibility. AAPL's M series chips are made by TSM in addition to their A-series chips. The A-series chips power AAPL's iPhone, which accounted for $191.97 billion in revenue (52.48%) of AAPL's 2021 revenue, and most of their iPads which accounted for $31.86 billion (8.71%) of AAPL's revenue in 2021. The M chips are being deployed in new iPads and their PC segment as they shift away from INTC and AMD.

In the event that a dire situation occurs, the entire global supply chain would be impacted from production down to transportation. There is no way to quantify what may or may not occur or how deeply the effects would be. The bigger problem is that Samsung only accounts for 17% of the market, based out of South Korea, and GlobalFoundries accounts for 7% which is found domestically. With INTC and AMD being tied to TSM, AAPL can't just backfill from these vendors if their supply chain with TSM becomes compromised. Another problem for AAPL is that Samsung is the only company that can replicate TSM's 5-nanometer chips that go into iPhones. The current chip shortage is already projected to have lasting effects into 2023, and there is no telling how bad the situation could become if China invades Taiwan. INTC and Samsung have made large capital investments to build more foundries domestically in the United States, but these chip factories take years to build regardless of how much money is thrown at the project.

From a share price perspective, it's difficult to make projections to the up or downside, but in this case, it's even harder. Hypothetically if China invades Taiwan and the global chip supply is affected, we must assume that AAPL's supply will be impacted. Just on the news alone, there could be a selloff in the overall market, then targeted sell-offs in specific companies with exposure to semiconductors. If there is an influx of sellers, it could trigger stop losses and computer algorithms to trade in and out of AAPL which could accelerate a move to the downside. On the positive side, AAPL is the largest name in many of the largest large-cap, total market, and S&P index funds, and those holdings are unlikely to change. Berkshire Hathaway (NYSE:BRK.A) also owns more than 5% of AAPL, and they would be an unlikely seller also. Shares of AAPL would find support somewhere, but if AAPL falls, it will take the market with it, and I don't know if $130 is where it stops, $110, or sub $100. These are hypotheticals based on events that may or may not occur, but with Russia invading Ukraine, it's not out of the realm of possibility that China follows in their pursuit of Taiwan. Hopefully, we never have to experience this, but it will be next to impossible for AAPL not to be impacted if it occurs.

The other side of the coin is a much brighter scenario where AAPL forges on and reaches $250 in the future

The market has turned on a dime, and growth is no longer king. The market wants to see FCF and EPS growth instead of revenue as we enter a rising rate environment. The market wants predictable cash flow and EPS so give your portfolio what the market wants, $100 billion in both net income and FCF during a trailing twelve-month (TTM) period. I have previously indicated that the best defensive play in this type of environment isn't your typical consumer goods company; it's investing in AAPL and playing offense.

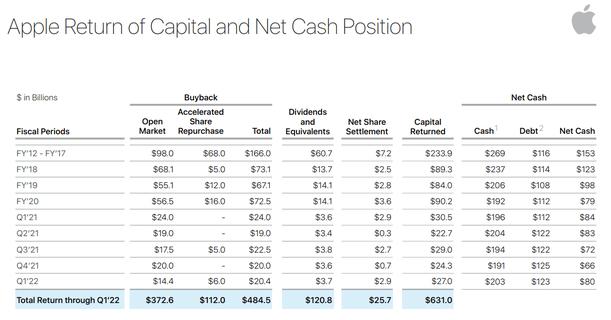

Let's start with financial power. AAPL can continue to manufacture better earnings QoQ in addition to simply growing their net income. In other words, don't fight the buyback. EPS is (net income - preferred dividends) / shares outstanding. In 2021 AAPL generated $94.68 billion in net income and had 16,864,919,000 shares outstanding, which accounted for their $5.67 EPS. So what do I mean by manufacturing higher earnings? AAPL continues to aggressively buy back shares. At the end of Q1 of 2022, AAPL had retired 543,395,000 shares YoY, reducing their share count by 3.21%. On the Q1 2022 conference call, AAPL's CFO Luca Maestri indicated that AAPL returned nearly $27 billion to shareholders during the December quarter. This included $3.7 billion in dividends and equivalents and $14.4 billion through open market repurchases of 93 million AAPL shares. AAPL also began a $6 billion accelerated share repurchase program in November, resulting in the initial delivery and retirement of 30 million shares.

AAPL has $63.91 billion in cash and marketable securities under its current assets and another $138.68 billion in marketable securities under its long-term assets. With $200 billion in cash and cash equivalents on its balance sheet, while producing more than $1.5 billion in FCF each week, I am certain this trend will continue. So, what happens if AAPL generates the same amount of net income but continues its buybacks and retires shares at the same rate? Based on the 2021 numbers AAPL would generate $94.68 billion in net income and retire another 543,395,000 shares YoY, reducing the share count to 15,848,329,000. AAPL's EPS would increase from $5.67 in 2021 to $5.97 without generating an increase in net income simply by continuing its buyback program.

Let's look at what AAPL did in Q1 of 2022. In Q1 2022, AAPL generated $34.63 billion in net income and had 16.39 billion shares outstanding, bringing their EPS in at $2.11. In 2020 AAPL generated $28.76 billion in net income, had 16.94 billion shares outstanding, and their EPS was $1.70. Not only did AAPL's net income increase by $5.87 billion (20.41%) YoY in Q1, but their shares outstanding decreased by 543.4 million (-3.21%), causing their EPS to increase by $0.41 or 24.12%.

AAPL produced $123.95 billion in revenue, $34.63 billion in net income, and $44.16 billion in FCF. AAPL generated 28.55% of 2021s record revenue, 36.58% of 2021s record net income, and 47.51% of 2021s record FCF in the first 3 months of the fiscal year 2022. AAPL didn't give specific guidance, but they did indicate that they are expecting year-over-year revenue growth and that March will be a record Q2. My unofficial projection for the fiscal year 2022 based on AAPL's Q1 and Q1 commentary is $380 billion in revenue, $105 billion in net income, and $110 billion in FCF. If my unofficial projection occurs with $105 billion in net income and if that is combined with the same rate of share retirement, AAPL should produce $6.63 in EPS for 2022, an increase of $0.96 in EPS per share or 16.93% YoY. If AAPL's net income comes in exactly where it did in 2021, AAPL can manufacture better YoY earnings by continuing its buyback program. AAPL is already $5.87 billion ahead of the game compared to 2021 for net income generated, and if they continue to outpace 2021 and retire shares, we could see double-digit EPS gains in 2022. Either way, AAPL can give the market what it wants in a rising rate environment, EPS growth.

In addition to their financial power, AAPL has several future catalysts which could drive revenue higher over the next several years

Morgan Stanley (NYSE:MS) sees the Metaverse as an $8.3 trillion TAM in the U.S, depending on the level of its disruption. U.S. daily users of social media, streaming, and gaming already spend the total equivalent of about 11 billion days per year consuming digital media and about 14 billion annual days watching linear television. There are tremendous possibilities for consumer time to be diverted to the Metaverse. AAPL is going to be a critical player in the Metaverse space. AAPL already has an augmented reality site as part of its overall website. AR experiences are already being built for their App store, and APPL has a developer kit to accelerate the process for augmented reality experiences created for the iPad and iPhone.

Rumors are circling that AAPL is going to deliver AR and VR headsets in Q4 of 2022 with Wi-Fi 6 and 6E support. There are also reports that AAPL will also deliver smart glasses around 2025 and possibly an AR contact Lens after that. We don't know how disruptive the Metaverse will be, but we know Meta Platforms (NASDAQ:FB) is all in, and AAPL is positioning to take a chunk of the TAM. We know that technology continuously evolves, and with the amount of capital thrown at the Metaverse, there will probably be a large adoption rate. AAPL will drive revenue and profits from hardware, the app store, and in-app purchases through the Metaverse.

AAPL is expected to enter the automobile market by 2025. There are reports that Kevin Lynch is making the push to make 2025 a reality. Whether AAPL can deliver a fully driverless car remains to be seen, but I wouldn't bet against them. AAPL has been at the forefront of AI and ML for years with consumer products. AAPL has an unlimited war chest with $200 billion in cash on the books and generating $100 billion in FCF. AAPL can outspend the competition, and they are already a leader in software and application integration.

What is more likely to occur is that AAPL teams with a specific manufacturer for an AAPL car and creates an AAPL car package for the other manufacturers. I think AAPL wants to own the inside from the software that the car operates from to the in-car experience. AAPL will probably integrate their hardware products to sync with the car and make their software sought after by auto manufacturers. Many Tesla (NASDAQ:TSLA) fans will think this is crazy and discuss the countless miles of data collected from their vehicles. AAPL has been collecting data longer from the iPhone and already has the entire U.S mapped out.

Lastly, I think Services will continue to drive revenue. Over the past four years, Service's quarterly revenue has increased by $10.39 billion (113.78%) from $9.13 billion to $19.52 billion. In Q1 2019, Services revenue increased by 19.13% YoY, then by 16.92% YoY in 2020, 23.96% YoY in 2021, and recently by 23.82% YoY in 2022. Over the past 4 quarters, the QoQ Services growth rate was 5.5%, as $19.52 billion of revenue was generated in Q1 2022. If I extrapolated, this out Services would generate $20.59 billion in Q2, $21.72 billion in Q3, and $22.92 billion in Q4 for a total of $84.74 billion in revenue for the 2022 fiscal year. If the average QoQ growth rate was to drop to 4%, this would put the annual revenue for services in 2023 at $101.21 billion and $118.4 billion in 2024. When you think about the possibilities from the Metaverse and even the automobile industry, which is more speculative at this point, these two sectors could drive additional revenue reoccurring in the Services division. 2023 could be when Services become a $100 billion revenue segment. Hypothetically, if I speculate and say that Services does reach $84.74 billion in 2022, then has a 3% QoQ growth rate through 2029, its 2029 revenue would be $200.74 billion.

Conclusion

Geopolitical tensions are extreme, and the threat of China invading Taiwan must be looked at as a possible outcome. If China does invade Taiwan, then we're going to have much bigger problems than AAPL's stock price. For those of us interested in finance, this scenario would drastically impact APPL, but the extent is uncertain. There is no telling how deep the initial impacts would affect AAPL's share price in the near term, and it's always a possibility that AAPL could decline to $100 or lower. Personally, I believe if China was going to invade, they would have already acted. China is on track to become the world's largest economy by 2028, and invading Taiwan would significantly impact its future goals. I think China has evaluated the global response to Russia and hopefully has decided not to move forward.

I think AAPL is a buy here as it's roughly 10% off its 52-week highs, but there could defiantly be better buying opportunities in the future. Long-term AAPL is the strongest company financially in the U.S and is on track to generate more than $100 billion in both net income and FCF in their 2022 fiscal year. The market wants EPS and FCF growth instead of hyper revenue growth, and AAPL can deliver on both fronts. AAPL can manufacture EPS growth without a single dollar of new profits in 2022 just by continuing its buyback program. Suppose we don't get any more geopolitical surprises. In that case, I am estimating that AAPL will produce $380 billion in revenue, $105 billion in net income, $110 billion in FCF, and $6.63 in EPS for 2022, an increase of $0.96 in EPS per share or 16.93% YoY. Long-term, I think AAPL has multiple catalysts to help its shares reach $250 by 2024 if another world war doesn't occur.